The Ultimate Guide To Obtaining Copy Of Bankruptcy Discharge Papers

Table of ContentsIndicators on Copy Of Chapter 7 Discharge Papers You Need To KnowExcitement About How Do You Get A Copy Of Your Bankruptcy Discharge PapersGetting My Chapter 13 Discharge Papers To WorkUnknown Facts About How To Obtain Bankruptcy Discharge Letter

Wedded individuals should gather this information for their partner no matter whether they are submitting a joint request, separate specific requests, or perhaps so one spouse is submitting (bankruptcy discharge paperwork). In a situation where just one spouse data, the earnings and also expenditures of the non-filing partner are called for to make sure that the court, the trustee as well as lenders can examine the household's financial setting.Hence, whether certain home is exempt as well as may be maintained by the borrower is frequently an inquiry of state law. The borrower must consult an attorney to determine the exemptions readily available in the state where the borrower lives. Filing an application under phase 7 "immediately stays" (stops) the majority of collection actions against the debtor or the borrower's home (how to get copy of chapter 13 discharge papers).

362. Filing the application does not remain particular types of actions noted under 11 U.S.C. 362(b), and the remain might be reliable only for a short time in some circumstances. The stay arises by operation of law as well as needs no judicial activity. As long as the keep holds, financial institutions normally might not start or continue legal actions, wage garnishments, or even phone conversation demanding repayments.

trustee will report to the court whether the instance need to be assumed to be an abuse under the ways test defined in 11 U. https://www.openlearning.com/u/saulstanley-rghqfz/about/.S.C. 704(b). It is crucial for the borrower to accept the trustee and to supply any type of monetary documents or documents that the trustee demands. The Insolvency Code calls for the trustee to ask the borrower inquiries at the meeting of creditors to make sure that the borrower is conscious of the potential consequences of seeking a discharge in bankruptcy such as the effect on credit report, the ability to file an application under a various chapter, the impact of obtaining a discharge, and the effect of reaffirming a financial debt.

The Main Principles Of Obtaining Copy Of Bankruptcy Discharge Papers

If all the borrower's possessions are exempt or subject to legitimate liens, the trustee will typically file a "no asset" record with the court, as well as there will be no circulation to unprotected lenders. A lot of chapter 7 instances entailing specific borrowers are no asset cases.

Although a safeguarded creditor does not require to submit an evidence of insurance claim in a phase 7 case to maintain its safety and security passion or lien, there might be various other reasons to file a claim. A creditor in a chapter 7 situation that has a lien on the borrower's residential or commercial property ought to consult an attorney for suggestions.

It consists of all lawful or equitable Recommended Site rate of interests of the borrower in home since the start of the instance, including building had or held by one more person if the borrower has a rate of interest in the residential property. how do you get a copy of your bankruptcy discharge papers. Typically speaking, the debtor's lenders are paid from nonexempt residential or commercial property of the estate.

Excitement About How To Get Copy Of Bankruptcy Discharge Papers

The trustee achieves this by offering the borrower's property if it is totally free as well as clear of liens (as long as the residential property is not excluded) or if it is worth greater than any type of security passion or lien affixed to the residential property and any kind of exception that the borrower keeps in the property.

Additionally, if the borrower is a company, the personal bankruptcy court might authorize the trustee to operate business for a limited time period, if such operation will benefit financial institutions and enhance the liquidation of the estate. 11 U.S.C. 721. Section 726 of the Personal bankruptcy Code governs the circulation of the residential property of the estate.

The debtor is only paid if all various other classes of claims have been paid completely. As necessary, the borrower is not particularly interested in the trustee's personality of the estate properties, other than relative to the payment of those debts which for some factor are not dischargeable in the bankruptcy situation.

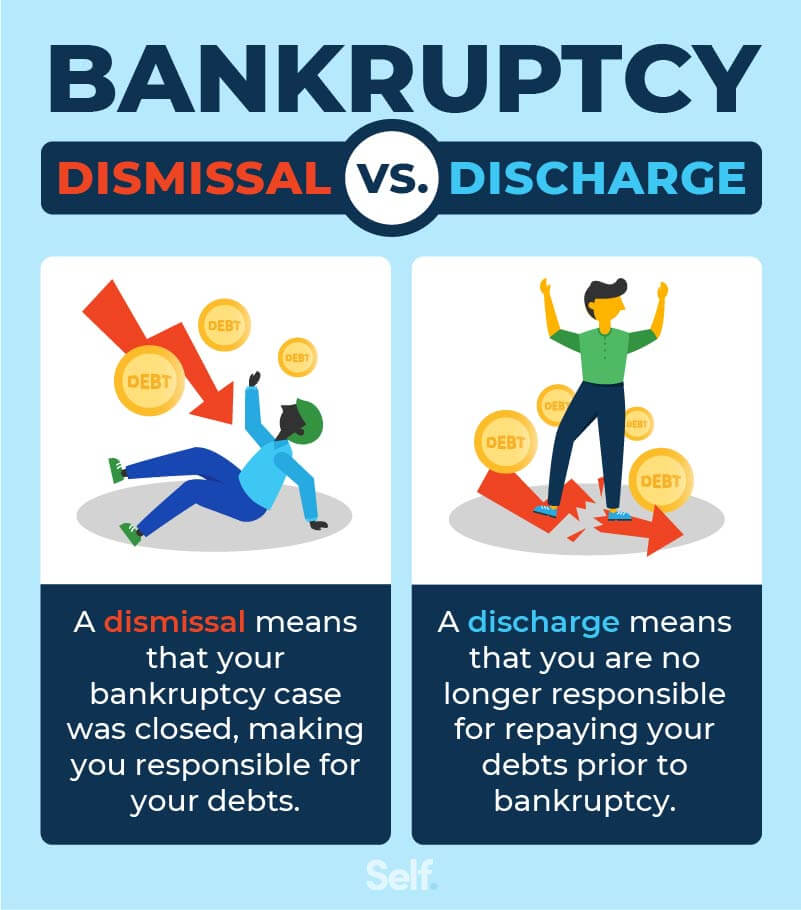

A discharge releases private borrowers from individual obligation for many debts and also prevents the creditors owed those financial obligations from taking any collection actions against the borrower. Since a phase 7 discharge undergoes many exemptions, debtors need to seek advice from competent lawful counsel before submitting to discuss the scope of the discharge.

How To Obtain Bankruptcy Discharge Letter Things To Know Before You Buy

In return, the financial institution assures that it will certainly not reclaim or repossess the automobile or various other property as long as the debtor proceeds to pay the debt. If the borrower makes a decision to reaffirm a debt, he or she have to do so before the discharge is gone into. The debtor needs to authorize a created reaffirmation arrangement and also file it with the court (https://www.cnet.com/profiles/b4nkruptcydc/).

524(c). The Insolvency Code requires that reaffirmation agreements have a considerable set of disclosures defined in 11 U.S.C. 524(k). To name a few points, the disclosures must encourage the borrower of the amount of the debt being declared and exactly how it is determined which reaffirmation implies that the debtor's individual liability for that financial obligation will not be discharged in the personal bankruptcy.

524(f). A specific receives a discharge for the majority of his or her financial debts in a chapter 7 bankruptcy situation. A creditor might no more start or proceed any kind of legal or other activity versus the debtor to gather a released financial debt. But not all of an individual's debts are discharged in chapter 7.